For high-net-worth clients, there are few sources as trusted as financial advisors for information on charitable giving.

In fact, when it comes to philanthropic decisions, advisors are bested only by one other type of confidant: spouses and partners, according to a survey by U.S. Trust.

That level of rapport can help advisors either cement a relationship or lead to its undoing. Wealthy clients’ expectations for top-quality advice extend well beyond how charitable giving will impact their finances or taxes. They want recommendations about specific vehicles to use, and sometimes, they even ask for help selecting a worthy cause. Advisors need to step up to fully service this need or risk losing out to a competitor who will.

Less than half of high-net-worth clients reported being satisfied with the philanthropic discussions they’ve had with their advisors, according to the

“Philanthropy can be a differentiator for a manager. It can strengthen a client relationship over the long term and even extend to multiple generations,” says Henry Berman, CEO of Exponent Philanthropy, a philanthropy membership association.

That’s a fact many advisors have already witnessed. More than three-fourths of advisors say they have noticed a positive impact to their bottom line after having philanthropic discussions: 60% reported it helped them find new clients, 74% said it deepened existing client relationships and 63% found it allowed them to build relationships with the client’s extended family.

Extending an advisor's “share of family” for this reason can help insulate a firm from a steep business drop-off when older clients leave behind an inheritance to their children.

“Younger generations tend to be more social-minded than previous generations, and this is a good way to build a relationship with them,” Berman says. “I’ve observed that the next generation will switch advisors in a heartbeat when there is a wealth transfer if there is no existing relationship with their parents’ wealth advisors. So it makes sense to work with the entire family, and philanthropy is one of those legacy issues that people typically want their children and grandchildren to be a part of.”

Understandably, some advisors are on the fence about heavily engaging clients on this topic, probably because they’re worried about losing income. After all, why would an advisor want to help clients essentially deplete the assets they have under management?

“Some advisors think they are hurting themselves by doing the right thing, but what we’ve found is the opposite. Helping clients give away money makes you a more valuable resource to them,” says financial planner Mitchell Kraus, who co-founded Capital Intelligence Associates in Santa Monica, California. “We’ve had clients brag about how we’ve helped them support their favorite cause, and it’s become a great referral service for us.”

Below are some tips recommended by the study and advisors themselves on how to effectively bring up charitable giving. Whether you’re just beefing up your expertise in this area or you’ve made it a featured point of your firm, it’s important to talk about philanthropic goals with clients.

Bring the topic up early: Advisors underestimate how soon clients want to have discussions about philanthropy, the U.S. Trust study found.

Typically advisors prefer to wait until they have detailed knowledge of the client’s financial picture or know more about his or her personal life to raise this subject, but clients aren’t as keen to wait.

Almost a third of clients surveyed want to talk about charitable giving at their first meeting and another third feel it should come up within the first few meetings.

But just how to approach the topic with a client — especially one who isn’t actively asking about it — can be a big hurdle.

“It can be tricky to bring up since it is such a personal thing,” says financial planner Seth Corkin with Boston-based Single Point Partners. “You don’t want them to think: ‘This person is judging me, they don’t think I’m giving away enough of my money.’”

Advisors, who focus on charitable giving, have a whole host of tricks to get at the matter without putting clients off.

“One way to gauge how that client views charitable giving without putting them on the spot and asking is by reviewing several years of tax returns to understand how they gave and how much they gave,” Corkin says.

To bring up charitable giving even earlier — say before a client has delivered documentation on past finances — many advisors like to shift the focus to goals or questions about values to determine how to broach the topic.

“Don’t approach a client with ‘are you philanthropic?’” says Arlene Cogen, a financial planner and philanthropic leadership consultant. “Ask instead broad-brush questions that will allow you to spot if they’re interested in giving and help guide that giving. What do they want to be remembered for? How do they define success? What was important to their success? What was something meaningful that happened to them that was made possible by the money they have? Make it a discussion of values and life lessons.”

For existing clients, regular estate plan reviews or a sudden increase in assets, like a large inheritance or business sale, can serve as catalysts to raise the topic again. Ensure the estate plan reflects the legacy a client wants to leave, and in the case of a sudden asset increase, make sure the client understands how charitable giving may reduce his or her taxable income.

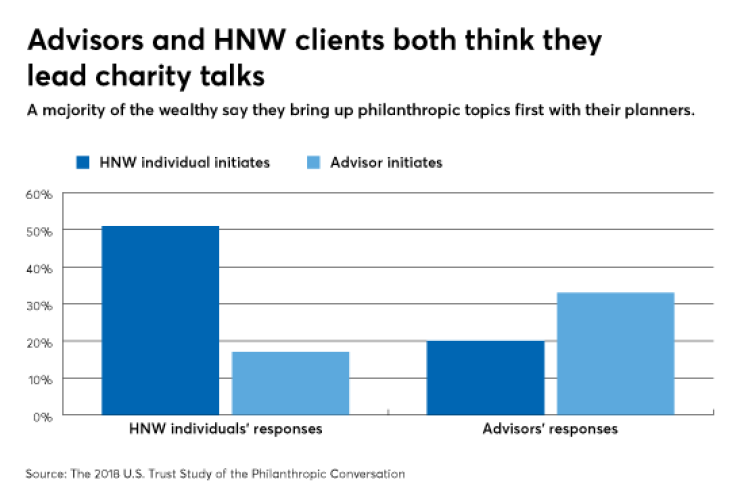

Regardless of what method you chose, the important thing is that you have the talk soon and in a way that sticks in the client’s mind. In the U.S. Trust survey, 61% of clients said they have had to raise the subject themselves, despite advisors reporting that they usually initiate the conversations.

Make it personal: Easing into conversations around charitable giving by inquiring about a person’s values, passions, goals or background not only saves you from appearing judgmental or pushy, but also can endear you to clients.

Unsurprisingly, advisors tend to be thorough about discussing technical aspects of charitable giving such using donations for tax benefits or estate-planning purposes, but clients would prefer an initial approach that balances those financial topics with more personal aspects of giving such as what motivated them to give, what charities they are interested in, what their philanthropic goals are and what kind of legacy they want to leave.

Not only do clients want to share their connection to giving, they want to hear about yours. Clients actually care about the philanthropic activities their advisor or their advisor’s firm participates in. That kind of firsthand experience can inspire greater confidence in the advisor’s philanthropic advice. In fact, more than half of clients place greater value on information that comes from advisors who donate, themselves.

Unfortunately, only 1% of advisors say they use their own stories to lead a conversation, but one in 10 clients said they would prefer this approach.

Daniel Andrews, a financial planner and founder of Well-Rounded Success in Fort Collins, Colorado, says he likes to share personal stories about his own volunteering and giving efforts in blog posts, on social media and in conversations as a way to show clients he practices what he preaches. Those posts also encourage clients to brainstorm about the nonprofits or volunteer opportunities they may want to participate in.

He also asks his clients to help him choose the charities he supports.

“Every year, I give away 2% of my company’s top-line revenue to a charity my clients choose. I send out a survey and allow them to vote for one of three nonprofits I’ve selected they would like the money to go to,” says Andrews. “I have a banner on my website which says this, and I feel like it disarms clients. It sets the tone that money is important but that I also feel it is important to give back.”

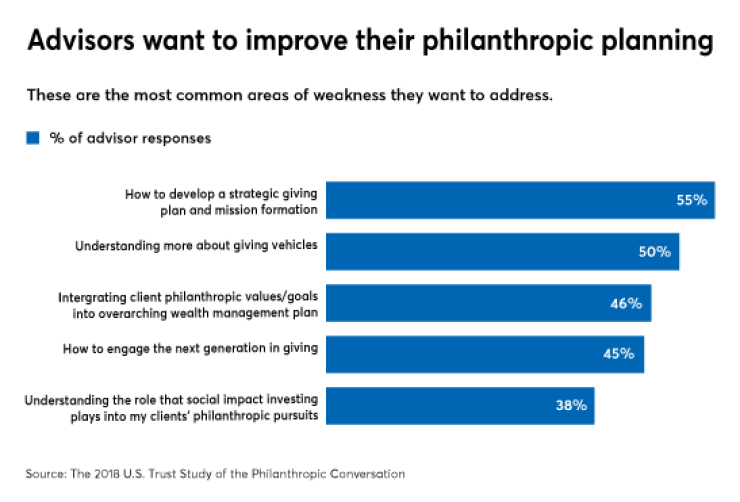

Increase structured giving vehicle knowledge: While clients surveyed by U.S. Trust were largely happy with the advice they’d received about charitable trusts, private foundations and donor-advised funds, advisors were less satisfied.

Many admitted that they want to improve their understanding of philanthropic giving and structured-giving vehicles. For instance, less than half of advisors rated themselves as very familiar with private foundations and donor-advised funds.

The tax law changes in 2018 have put further pressure on advisors to rethink how they direct clients to give. An increase to the standard deduction, for example, means many people who previously itemized and therefore received a tax break for their charitable giving may no longer be eligible for a deduction. Giving vehicles like donor-advised funds can help advisors plan a little more creatively and help clients ease their tax burden.

“It's more crucial than ever to understand a client's tax situation, and whether they are expected to itemize or take the standard deduction each year, in order to optimize their charitable giving each year,” Corkin says.

One approach that’s become more attractive in the new tax environment involves lumping donations together in a single year within a donor-advised fund.

“If someone gave $10,000 per year to various charities, we might recommend contributing three to five years worth of gifts ($30,000 to $50,000 in this example) into a donor-advised fund,” says Joshua Stillman, an advisor with Capitol Financial Consultants in Mclean, Virginia. “They can then use the donor-advised fund to grant out $10,000 per year as they had done before, but from a tax perspective, they might receive more tax benefits as they can itemize deductions in one year and take the standard deduction in intervening years.”

Learning about these vehicles also provides advisors with the opportunity to connect with a client’s family.

“If a family sets up a donor-advised fund or private foundation, grantors can include children and grandchildren as donor-advisors or trustees, or at the very least, set aside some annual grants to be made as family decisions,” Stillman says. “This can facilitate a family discussion on values, causes and types of organizations the family agrees and disagrees on supporting.”

Learn about nonprofits: Clients want guidance from their advisor about how to vet and select causes, but many advisors are unaware or unprepared to meet this need.

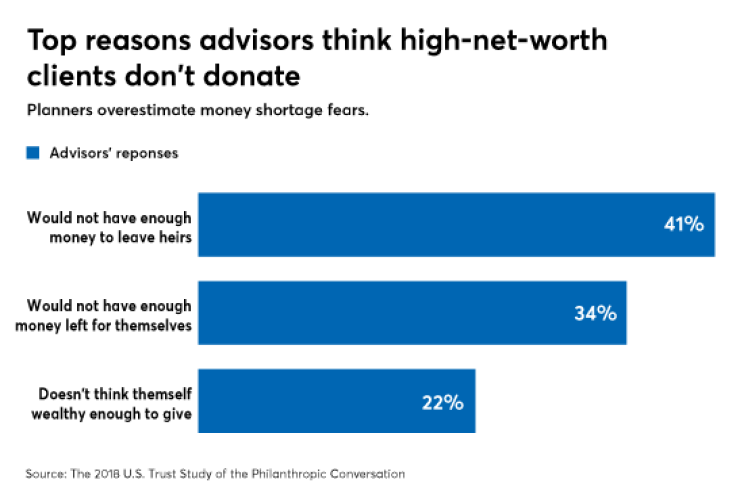

The reasons most clients give for not donating or holding back on giving include a lack of connections to nonprofit organizations and a fear that their gifts would not be used wisely. Advisors, on the other hand, completely miss the mark thinking their clients are hesitant to give because of fears about not having enough money for themselves or heirs.

This presents a big opportunity for advisors to beef up their general knowledge of philanthropy and get acquainted with nonprofits so that they can become that resource clients are seeking. Of course, walking the balance between helping them do that and coming across as an advocate for a specific nonprofit can be tricky.

“Planners can be more involved in the actual giving strategy by helping them identify and articulate what causes they want to focus on,” Stillman says.

When clients already have specific organizations in mind, advisors can direct them to do a little online digging by pulling up the organization’s IRS Form 990 and other financial reports on

Sites like

When clients want to target a broad cause like environmental pollution or LGBTQ rights but do not have a specific organization in mind, advisors can also recommend digital tools to find credible nonprofits.

For smaller or local charities, sites like

In some cases, it pays to build relationships with local community organizations to support clients who want to give within their hometown. Patti Black, a financial planner and partner at Bridgeworth in Birmingham, Alabama, has formed a connection to a community foundation that holds meetings with potential donors and then coordinates site visits to several nonprofits in line with their interests. The connection allows Black to steer clients to a helpful resource and makes her appear more knowledgeable.

“I recently met with a couple that wanted to be giving more. The husband’s dad was a big giver and he had seen how it shaped his outlook and wanted to model that for his own sons, but they weren’t doing any giving with the kids,” Black says. She recommended they put some of the $350,000 in stocks he had inherited in a donor-advised fund and then meet with the local community foundation. She further suggested they include the two sons in their visit and allow them to help draft a giving plan.

Implementing some of these strategies can also boost clients’ perceptions of advisors’ guidance on nonprofits. Only a fourth of advisors were deemed “very capable” when it came to advising clients on local and national nonprofits by their clients, according to the U.S. trust study. They fared even worse with international organizations; only 16% received top marks.

Advisors who address this shortcoming could one day usurp spouses as the top-trusted source on giving ...

Maybe.